The Human View™ Blog

The Future Was Yesterday? VBs Hurtle Towards 2025

The clock is ticking. 2025 open enrollment is right around the corner, and the cutting-edge trends, disruptive technologies, and evolving employee expectations are already shaping the landscape. So, if you're thinking maybe we should just take things incrementally — well, that may not be quite enough.

Buckle up - VBs are colliding with all sorts of "perks"

The demand for personalized, holistic well-being is skyrocketing, and voluntary benefits are jockeying for how they'll hold on to center stage. While not forgetting accident, CI & HI - or even Life + LTC, 2025 is beckoning us towards expansion, and no longer just whispering about niche offerings, but calling straight out for more options to meet individual needs and values, going even beyond what's emerged in recent years:

Financial wellness programs - Think student loan assistance, earned wage access, and personalized financial coaching. But there's more - wills and trusts, crypto-currency management, digital payment apps and wallets, etc.

Mental and emotional health - Beyond traditional therapy, expect on-demand mindfulness apps, virtual support groups, and digital therapeutics, along with reduced stigmas around seeking help.

Lifestyle benefits - Not just pet insurance, but pet-sitting; not just identity theft protection, but proactive, dark-web personal data scrubbing; not just childcare, but home nanny care. Or how about more medical travel, commuter assistance, and interest-free PRD purchasing platforms?

Tech moves front and center for the 2025 O/E experience

Yeah, we've heard it already, but it's now starting to get its "boots on the ground:" Artificial Intelligence (AI) is poised to revolutionize how employees engage with their benefits.

More personalized recommendations - GenAI-powered platforms will analyze individual data points (age, health history, family status) to recommend the most impactful benefits. And the algorithms are getting more and more sophisticated. Srsly.

Interactive, conversational chatbots - Forget clunky FAQs; employees will engage with intelligent chatbots that provide instant answers and guidance throughout the enrollment process.

Predictive analytics for employers - Using historical data and real-time insights "hoovered up" via APIs, AI will keep getting better at helping employers anticipate future healthcare costs - and the cost drivers. More tailored and culture-relevant benefit packages that increase the odds for optimal employee uptake and cost savings will begin to emerge.

Data is still king - but knowledge is even better

The demand for transparency and data-driven, real-time decision-making and monitoring is stronger than ever. APIs will be the backbone of sophisticated reporting dashboards, providing:

Real-time enrollment data - HR departments and consultants will gain instant visibility into employee enrollment trends, allowing for agile adjustments and optimized communication strategies.

Layering in psychographics to deliver ever more personalized "What's-in-it-for-me" (WIFFM) and "Why-should-I-care" (WSIC) recommendations will help drive better employee recruitment and retention results.

Cost tracking and analysis - Employers and consultants will be able to track benefit utilization and spending patterns, enabling proactive cost management and data-driven negotiations with vendors.

Lifestyle spending accounts (LSAs): a new frontier

LSAs offer a flexible, often tax-advantaged way for employees to pay for a wide range of well-being and non-insurance/traditional benefit expenses. This emerging trend demands a shift in benefit design:

Attracting and retaining top talent - Employers that offer LSAs will have a competitive advantage in attracting and retaining employees seeking personalized well-being support.

A more holistic approach to benefits - Integrating LSAs into overall benefit strategies requires a nuanced understanding of employee needs and a willingness to embrace innovative solutions.

The call to action: are you evolving with the times?

This isn't just a wake-up call—it's a siren blaring. Every stakeholder in the benefits ecosystem needs to adapt:

Benefit consultants will need to accelerate their expertise in emerging trends and technologies, guiding their clients toward innovative solutions and navigating the complexities of the evolving landscape.

Vendors must embrace APIs and data integration to deliver the real-time insights and personalized experiences demanded by employers and employees - including process integration and integrated reporting with other vendors.

HR professionals need to proactively engage with technology, step beyond transactional foundations into strategy-forward risk-taking to better leverage data analytics and AI-powered tools (supported by their consultants, of course) to optimize benefit strategies and enhance the employee experience, especially around how to drive higher enrollment and engagement in cost mitigation programs.

Employees must take ownership of their benefits, embracing the power of technology to make informed decisions and prioritize their well-being.

The last word

The future of benefits is ... here? Or was it already here, yesterday? Either way, it's being driven by personalization, technology, and a focus on holistic well-being.

It's not just about keeping pace with change; it's not just about "seizing the opportunity" to create a benefits experience that is more engaging, more impactful, and more responsive to the needs of a dynamic workforce.

It's really about building a future where benefits empower both employees and organizations to thrive. Somebody once said, "If you build it, they will come."

~ Mark Head

© 2024. All Rights Reserved.

Click the green button or the blue button (below) to visit our scheduling pages.

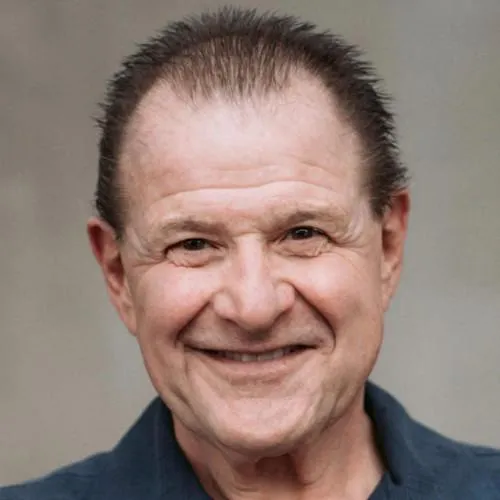

Mark Head

President

With 4 decades of combined experience in employee benefits consulting, wellness and health management, Head brings a unique combination of dynamic perspectives into a clear vision of where the future of health care is moving - and it's moving towards deeper human connection, awareness, and engagement...

Follow Us On

© 2025 Benefit Personas, LLC. All Rights Reserved.