The Human View™ Blog

How Interested in Voluntary Benefits are the 5 BenefitPersonas™?

As employers look to engage their employees with expanded benefit offerings, it’s crucial to understand how different personality types interact with voluntary and ancillary benefits. Our psychographic profiling data provides an in-depth look at how interest in these benefits is shaped by an employee’s health-related attitudes and behaviors.

This analysis focuses on various benefits, including accident insurance, hospitalization insurance, ways to fund deductibles, and more. Each benefit category is cross-referenced with the BenefitPersona™ segments, which range from proactive to reactive mindsets.

Accident insurance

Self Achievers showed the highest level of interest in accident insurance, with 26% being "Extremely/Very Interested" compared to only 9% of Priority Jugglers.

Willful Endurers, a more reactive group, had a surprisingly high level of interest at 28%, potentially driven by their experiences with health issues.

Takeaway: Messaging around accident insurance may resonate more effectively with highly proactive or high-need populations but requires different communication strategies for balancing seekers and more reactive personality types.

Hospitalization insurance

This benefit saw a higher interest among Self Achievers (34% "Extremely/Very Interested") and Direction Takers (31%), while Priority Jugglers showed the least interest (15%).

The data indicates that those who proactively manage their health are more likely to see the value in hospitalization insurance, which aligns with their desire for comprehensive health safety nets.

Takeaway: Framing hospitalization insurance as a crucial safeguard can appeal to proactive segments, while for more reactive segments, real-world scenarios showing the tangible benefits of this coverage could drive engagement.

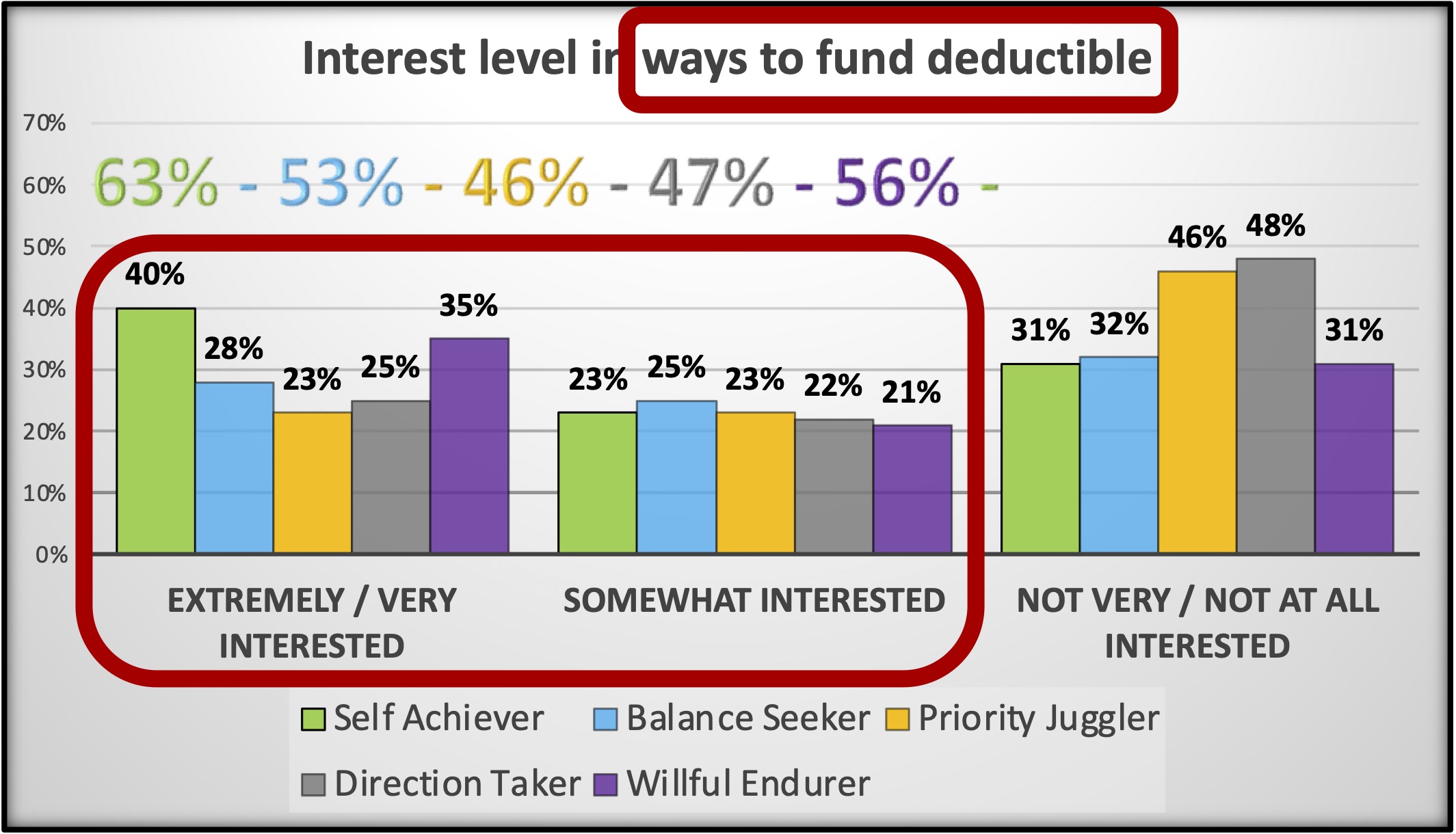

Interest in ways to fund deductibles

Importantly, when the question was not related to a specific product, but rather to ways to fund the deductible, interest levels went up.

Interest was strongest among Self Achievers (40%) and Willful Endurers (35%), underscoring the financial burden deductibles pose to both proactive and reactive segments.

Lower interest from Priority Jugglers (23%) suggests that those who juggle multiple priorities may not view funding deductibles as immediately relevant unless tied to their day-to-day challenges.

Takeaway: Highlighting how funding deductibles can relieve financial stress and enable access to care without delay can be a key strategy in reaching a broader audience.

Life insurance

Self Achievers and Direction Takers displayed the highest interest in life insurance (30% and 29%, respectively), while Priority Jugglers and Balance Seekers lagged significantly behind.

The appeal of life insurance might stem from a sense of long-term planning, which resonates more with proactive segments focused on future security.

Takeaway: Position life insurance as part of a holistic financial plan for future security to align with the values of more proactive individuals, while reactive groups may benefit from messaging that emphasizes immediate protection for loved ones.

Long-term care insurance

Interest in long-term care insurance followed a similar pattern, with Self Achievers (33%) and Willful Endurers (30%) showing the most interest.

Priority Jugglers and Balance Seekers again showed lower engagement, suggesting that long-term care planning may not resonate with individuals focused on immediate, day-to-day concerns.

Takeaway: Crafting messages around the importance of preparation for future health needs and aligning it with day-to-day realities can bridge the gap for more reactive segments.

Persona-specific communication strategies

One of the most critical insights from the report is the importance of value-oriented communication. Traditional, educationally-focused benefit explanations may fall flat, especially for more reactive personalities. Instead, aligning messaging with the underlying values and priorities of each health personality segment can trigger greater interest and engagement. For instance:

Self Achievers need messaging that emphasizes control, mastery, and long-term planning.

Willful Endurers respond well to narratives that speak to their resilience and practical needs in the face of health challenges.

Balance Seekers and Priority Jugglers may benefit from messaging that acknowledges their busy lives and offers simple, easily digestible solutions.

Marketing comes to benefits

The marketing industry - long ago - went from demographic segmentation or targeting to psychographic and behavioral. Now, as psychographic segmentation begins to improve the effectiveness of benefits communications, enrollment and engagement, it's almost as if using the term "employee" is like saying "American." Are we talking about New York, or LA?

And that is to say that employees can have wildly different priorities and feelings based on their values and preferences which, as humans, we've typically formed by the time we're in our late teens to early 20s. The inspiring thing here is that these quite different views and interest and desires are an incredibly important part, an increasingly powerful part of our companies.

They have highly individualized issues and needs. They're their own mosaic within a given company, and attempting to label them with any sort of homogenized views based on age or gender only is, increasingly, a waste of time.

The last word

It couldn't be clearer that there is a significant opportunity to better align benefit offerings by describing them in the language of employees' values. While we have a decent sense of what to expect from our typical one-size-fits-all approach, enrollment and sales rates can increase significantly by using psychographic profiling. By recognizing the distinct health personalities within an organization, consultants, enrollment firms, and benefit administrators can tailor their offerings and communication strategies to resonate more deeply, ultimately driving higher engagement and satisfaction.

~ Mark Head

© 2024. All Rights Reserved.

Click the green button or the blue button (below) to visit our scheduling pages.

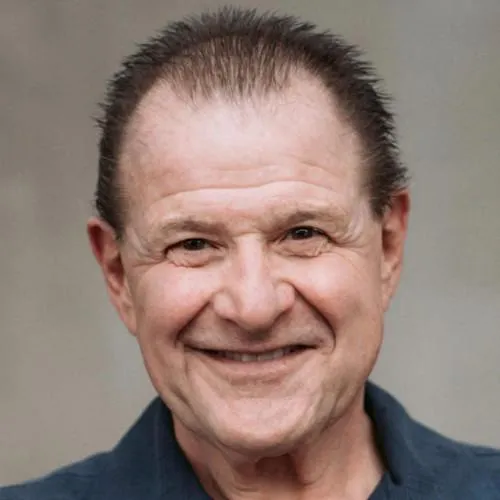

Mark Head

President

With 4 decades of combined experience in employee benefits consulting, wellness and health management, Head brings a unique combination of dynamic perspectives into a clear vision of where the future of health care is moving - and it's moving towards deeper human connection, awareness, and engagement...

Follow Us On

© 2025 Benefit Personas, LLC. All Rights Reserved.